As we look toward the horizon of 2026, the Edmonton real estate market continues to evolve, presenting both unique challenges and incredible opportunities for homeowners and prospective buyers. Whether you are eyeing your first condo in Strathcona, looking to upgrade to a family home in the suburbs, or seeking to leverage the equity you’ve built over the last few years, having a strategic roadmap is essential.

A mortgage isn’t just a loan; it is likely the largest financial tool you will ever manage. As your dedicated Edmonton mortgage broker, my goal is to move beyond the transaction. I am here to help you implement smart strategies that save you thousands in interest, pay off your home faster, and build genuine wealth. This guide serves as your comprehensive roadmap for navigating the property landscape in Edmonton, AB, as we approach 2026.

1. The 2026 Outlook: Navigating the Edmonton Market

Edmonton’s housing market has shown remarkable resilience compared to other major Canadian centers. With a stabilizing economy and a continued influx of new residents drawn to Alberta’s affordability, competition for quality homes is real. For 2026, we anticipate a market where preparation is the key differentiator between a successful offer and a missed opportunity.

Understanding local trends is vital. Through my I Love Edmonton Real Estate Podcast, I regularly interview local experts to keep my finger on the pulse of the YEG market. The consensus? Inventory is tight, and rates are fluctuating. This means you need an independent advocate who can navigate lenders on your behalf.

2. For Buyers: Strategy Starts Before the House Hunt

If your goal is purchasing a home in 2026, do not wait until you find the perfect property to think about financing. The “shoot first, ask questions later” approach can be costly.

The Power of a True Pre-Approval

Many online tools offer a “pre-qualification,” which is essentially a rough estimate. To compete in Edmonton’s 2026 market, you need a robust mortgage pre-approval. This involves a thorough review of your income, down payment, and credit history before you make an offer.

Why is this critical?

- Rate Protection: A pre-approval guarantees your interest rate for up to 120 days. If rates rise while you shop, you are protected. If they drop, we can often secure the lower rate for you.

- Budget Confidence: Know exactly what your monthly payments, property taxes, and heating costs will look like.

- Seller Confidence: In multiple-offer situations, sellers prefer buyers with secured financing.

First-Time Home Buyers

For those entering the market, understanding your down payment options is step one. In Canada, you can purchase a home with as little as 5% down for the first $500,000 of the purchase price. However, this requires mortgage default insurance (often called CMHC insurance). I can help you weigh the cost of this insurance against the benefit of entering the market sooner to start building equity.

3. For Homeowners: Refinancing and Debt Consolidation

If you already own a home in Edmonton, 2026 might be the year to restructure your finances. Many homeowners are sitting on significant equity but are simultaneously carrying high-interest consumer debt.

The Debt Consolidation Advantage

Credit cards and unsecured lines of credit can carry interest rates upwards of 19% to 29%. By utilizing a mortgage refinance, you can access up to 80% of your home’s value to pay off these debts. Even if mortgage rates are higher than they were a few years ago, they are significantly lower than credit card rates.

Example Scenario:

Imagine you have $30,000 in credit card debt at 19%. Your monthly minimum payments are high, and you are barely touching the principal. By rolling that $30,000 into your mortgage at a much lower rate, you could reduce your total monthly outgoing cash flow by hundreds of dollars, freeing up money to save or invest.

Renovations and Investment

Refinancing isn’t just for debt. You might want to access equity to renovate your current home—increasing its value further—or to use as a down payment on a rental property, expanding your real estate portfolio.

4. Mortgage Renewals: Don’t Just Sign the Letter

If your mortgage term is maturing in 2026, your lender will send you a renewal letter. Do not just sign and return it. Lenders often offer uncompetitive rates at renewal, banking on the fact that switching seems like a hassle.

At renewal time, you are essentially a free agent. This is the perfect time to:

- Shop around for better rates without penalties.

- Adjust your amortization to lower payments or pay off the loan faster.

- Switch from a variable to a fixed rate (or vice versa) depending on market conditions.

As an independent broker, I shop over 20 lenders to ensure your renewal offer is the best one available, not just the one your bank wants to give you.

5. Product Selection: Fixed vs. Variable in 2026

Choosing the right mortgage product is as important as the rate itself. The debate between Fixed and Variable rate mortgages is ongoing.

- Fixed Rate Mortgages: These offer stability. Your payment and interest rate stay the same for the term (typically 5 years). This is “peace of mind” insurance against rate hikes, making budgeting easier for families.

- Variable Rate Mortgages: These fluctuate with the Bank of Canada’s prime rate. Historically, variable rates have saved homeowners money over the long term, but they come with the risk of payment fluctuation.

We will analyze your risk tolerance and financial goals to determine which product suits your 2026 roadmap best.

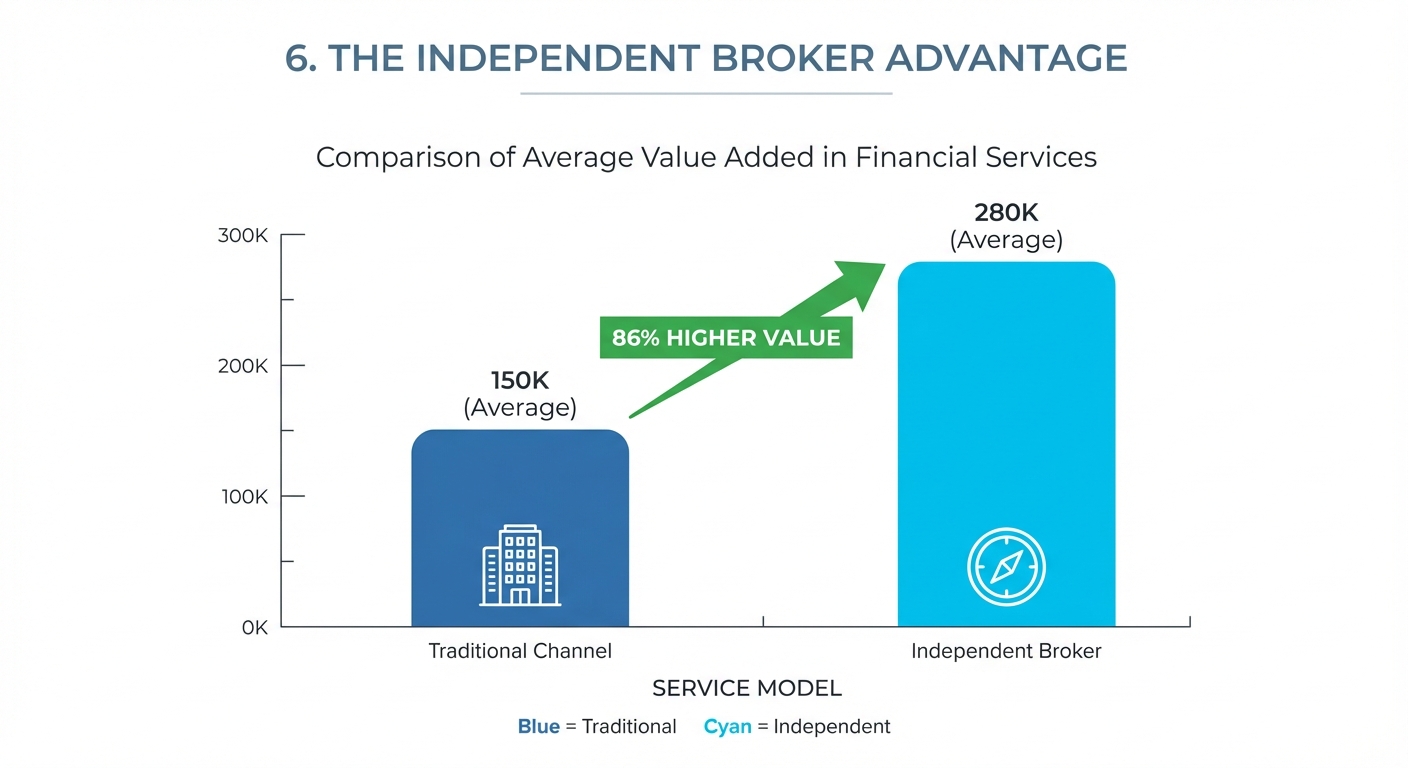

6. The Independent Broker Advantage

Why choose a broker over a bank? It comes down to choice, unbiased advice, and long-term strategy. When you walk into a bank, they can only sell you their specific products. When you work with me, I work for you, not the lender.

Comparison: Bank vs. Jason Scott (TMG)

| Feature | Big Bank | Jason Scott – TMG |

|---|---|---|

| Lender Access | Only their own products. | Access to 20+ lenders (Banks, Trust Companies, Monolines). |

| Interest Rates | Posted rates (often higher). | Wholesale rates (often significantly lower). |

| Advice | Employee of the bank. | Totally independent advice focused on your goals. |

| Availability | Banking hours only. | Flexible availability (calls/emails returned timely). |

| Long-Term Strategy | Transaction-focused. | Relationship-focused (Annual reviews, mortgage freedom planning). |

Frequently Asked Questions (FAQs)

1. What is the minimum down payment required for an Edmonton home in 2026?

For homes with a purchase price of $500,000 or less, the minimum down payment is 5%. If the home costs between $500,000 and $999,999, you need 5% on the first $500k and 10% on the remainder. For homes priced at $1 million or more, a 20% down payment is required. You can use my mortgage calculator to test different scenarios.

2. Should I choose a fixed or variable rate in the current market?

3. Can I use a refinance to pay off my car loan and credit cards?

Yes. This is a common strategy called debt consolidation. By refinancing, you use your home equity to pay off high-interest consumer debt. This consolidates multiple payments into one lower-interest mortgage payment, significantly improving your monthly cash flow.

4. How much does it cost to use a mortgage broker?

In most standard residential transactions (good credit, verifiable income), my services come at no cost to you. The lender pays the broker a finder’s fee once the mortgage funds. You get expert advice, rate negotiation, and paperwork management for free.

5. What happens if I want to break my mortgage before the term ends?

Life happens—you might move, separate, or want to refinance early. Breaking a mortgage triggers a prepayment penalty. For variable mortgages, this is usually three months’ interest. For fixed mortgages, it is the greater of three months’ interest or the Interest Rate Differential (IRD), which can be quite high. I help you select mortgages with fair penalty calculations to avoid expensive surprises later.

Start Your 2026 Journey Today

Whether you are planning to buy your first home, looking to consolidate debt, or facing a mortgage renewal, you need a strategy that looks beyond just the interest rate. You need a roadmap to financial success.

With over 15 years of experience in the Edmonton market and a track record of helping clients become mortgage-free faster, I am ready to guide you through the process. Don’t leave your financial future to chance or a rigid bank algorithm.

Ready to get started?

Contact Jason Scott today for a free, no-obligation consultation.

Call or Text: 780-721-4879

Email: jason@edmontonmortgagebroker.com

Apply Online Now